Scalable, secure fintech app development services tailored for payments, lending, and investing. Build smarter with compliance and tech expertise.

Fintech products are literally everywhere. When the cashier checks you out, when you pay in the clinic, when you receive a line of credit — all of it is tied to some form of financial technology.

Fintech software today covers a wide range of uses, helping financial services work faster, smarter, and more securely. Digital wallets, payment systems, and investment management tools are making an impact in more industries than you might think. To stay competitive on mobile, many companies hire React Native developers to deliver seamless cross-platform experiences.

Fintech has grown into an umbrella term that encompasses nearly every innovation in the financial sector. Whether you're launching a payments platform or a digital lending tool, successful fintech app development depends on choosing the right strategy from the very beginning.

This guide is designed to help you understand the complex world of fintech development services and what it takes to build modern, scalable fintech solutions that support your business growth.

Many businesses today, especially financial institutions, rely on fintech software development companies to bring their ideas to life. Why go through the hassle of assembling your own development team when a trusted software development company can jump right in and deliver high-quality fintech software development services that match your business needs?

Outsourcing allows you to access a global pool of technical expertise and stay competitive in an ever-evolving market. For projects that demand strong backend performance and enterprise-level stability, many teams choose to hire Java developers with deep domain expertise. For fintech products with complex interfaces and real-time data, many companies hire React.js developers to build fast, responsive user experiences.

Plus, with an experienced fintech software development company, you benefit from a refined development process that integrates regulatory compliance, modern software architecture, and the latest technologies — all without the overhead of building everything from scratch.

We've put together the most popular types of fintech products in 2025. These new ideas are changing how we manage money — digital banking, mobile payments, tracking investments, and more. Let's take a look.

Modern payment systems have to be quick, intuitive, and secure. That's why fintech software developers put so much emphasis on speed and user experience. To meet these demands, businesses often turn to custom mobile app development services that are tailored specifically for the financial sector.

Imagine all your cards in one place on your phone — it's no wonder mobile app development is booming for digital wallets. These tools handle a mountain of financial transactions, so compliance with financial regulations is non-negotiable. Creating sleek mobile banking apps means delivering custom software solutions that are legally sound and user-centric.

Some core features include peer-to-peer transfers for quick and easy money transfers, like sending birthday cash to your mom. QR payments are a favorite for businesses needing seamless app development services to handle quick checkouts. Transaction notifications give real-time alerts that improve customer satisfaction.

And don't underestimate the importance of the user interface. If your mobile app takes more than a few seconds to load, users will quickly turn to someone else's fintech solution.

In the modern financial industry, everything is measured — especially credit. That's where smart, cloud-based lending platforms come in, complete with tools for financial fraud detection software, risk management, and predictive analytics.

These platforms enable companies to launch credit services, establish lines, and evaluate customer trustworthiness at scale. When your client base starts pushing 1,000, your existing financial systems might buckle — so it's smart to look into scalable custom software development or a reputable fintech development company. Even elements like user trust and visual consistency play a role in adoption, which is why some founders also explore guides on how to hire a graphic designer for branding and interface design.

To keep up with industry trends, many systems now incorporate AI, big data analytics, and round-the-clock bots for financial operations like credit scoring.

Fintech has also infiltrated wealth management and investment management. With the right fintech tools, you can create a simulator of trading that recreates the whole market stock without losing any money for you. You can also use financial technologies to track portfolios and forecast the ups and downs of your investments. To support these kinds of data-heavy applications, many companies choose to hire Django developers for their expertise in building secure, scalable backends.

The forecast received a major upgrade in recent years. Now we can have bots that predict the behavior of the market and can make automatic investments for you. You can build a whole bot that will automatically react to any market opening, make predictions about payoffs, and invest your money in just seconds.

Users also expect clear dashboards and real-time insights into their portfolio management performance. By offering charts, news alerts, and personalized financial planning tools, you can turn your app into a go-to companion for both seasoned and newbie investors.

This type of tech is useful when creating a product that will be able to access sensitive information about the users. Usually, it is used in the medical field, but your credit card data is also pretty sensitive, isn't it?

RegTech consists of many products and integrations that make sure that your app or website stays in touch with laws and regulations. That's why many fintech companies choose to hire mobile app developers who understand how to implement data security and compliance features from the ground up.

Many RegTech services include risk dashboards, checking systems, and automated government report systems that send statistics and amounts of money you earned directly to the given bodies that oversee selling goods and services. Fintech developers ensure compliance while maintaining efficient financial processes.

The real charm of RegTech is how it saves time and cuts down on human error. With process automation solutions taking over tedious tasks like auditing and reporting, teams can focus more on growth and less on paperwork.

Blockchain is the main feature you can implement in your product in the modern world that will make your security basically unbreakable. Blockchain, in simple words, is a cipher that is based on keys and tokens that change with every layer of security you add.

Every blockchain system that protects data can include about 10,000 iterations of ciphering and deciphering unique security applications. When planning your product architecture, it's worth understanding the difference between web design vs web development to ensure your blockchain features are both secure and user-friendly.

If you work with sensitive financial data, make sure to include blockchain iterations in your product. Security is required by the law of any country, and with this technology, your protection systems will be on top of any other security feature the market has to offer.

Beyond just security, blockchain enables transparent transactions, real-time tracking, and the possibility to build decentralized applications — turning your financial product into something futuristic and ultra-reliable with secure transactions at every level.

Creating a fintech product means building something safe and following the rules from the start. Finance is one of the most heavily regulated industries, and for good reason. Every transaction and piece of financial data is carefully controlled, so developers need to build security in from the very beginning.

Fintech applications need some of the most sensitive data there is—bank account passwords, transaction history, personal financial records. As a result, encryption is standard—and it needs to happen on both sides of the equation: while in transit and at rest.

As developers build the software architecture, they infuse it with encryption protocols like AES or RSA so that, in the event of a breach, the financial data is unreadable to anyone who doesn't possess the key. It's like writing in code that only you and your customer can read. For companies looking to scale securely without overstretching internal resources, learning how to outsource web development can be a smart first step.

Fintech platforms rarely work in isolation — they rely on a lot of integrations, like third-party banking APIs or payment gateways. These connections are made through APIs, and if those aren't secure, your entire platform is at risk. To ensure these integrations run smoothly and securely at scale, many teams choose to hire backend developer talent with deep API expertise.

That's why financial software developers use authentication tokens, encrypted endpoints, and strict access control from the start. Designing secure APIs means thinking about who can access what and under what conditions — and testing those rules constantly.

The Payment Services Directive (PSD2) is an EU-based initiative that standardizes how FinTechs develop products that interface with banks. Instead of keeping information hidden and private, PSD2 mandates that financial institutions expose their APIs — securely.

Therefore, developers acknowledge this fact and build secure user-consent flows and audit trails to ensure data sharing is compliant and for the user's good. To make these complex flows intuitive and user-friendly, many fintech companies choose to hire frontend developer specialists who can translate regulatory compliance into clean design. This means that building for the rights to access such data is at the same level of importance as building for access utilities.

If your app ever processes credit or debit transactions, you're held to the standards of the Payment Card Industry Data Security Standard (PCI-DSS). These are the regulations determining how cardholder data is captured, stored, and transmitted.

Therefore, fintech developers often build compliance requirements into their CI/CD pipeline so that any time an update is made during development, it's assessed for PCI-DSS compliance. To streamline both frontend user flows and backend compliance logic, many fintech teams opt to hire full-stack developer professionals who can bridge both sides of the application. This way, regulatory compliance isn't a one-time check at the end of development but an ongoing endeavor.

Security means thinking about how things are built. Developers keep systems safe by separating services, using firewalls, and giving users only the access they really need. For startups building secure products from the ground up, understanding how to hire a full-stack developer can be the key to getting both frontend and backend protection right.

This way, even if a hacker gets in, it's much harder for them to do damage. It's like locking not just your front door, but every room in your house.

Fintech products can be created using a variety of tools like frameworks or programming languages. Modern fintech platforms are built on a foundation of technology that emphasizes speed, scalability, and security. For globally distributed teams or startups scaling quickly, learning how to hire remote developers can make all the difference in accessing top-tier talent without borders.

Digital banking, mobile payments, investment apps, and digital wallets must operate reliably under heavy load, integrate with existing systems, and adapt quickly to user needs. It's important to choose the right tech stack when creating a fintech product to ensure its scalability, speed, and agility.

At the heart of any fintech product is its backend — the system that handles user data, processes payment processing, and makes sure the overall application stays stable. Developers often turn to Node.js, Java, and Go to build this foundation. For founders building their first digital product, understanding how to find a web developer with backend expertise is often the first real step toward turning vision into code.

Node.js is famous for its dynamic event-driven infrastructure that allows quick responses from different parts of the system based on a single event in one point in time. It's a long-standing choice for enterprises that create payment processing systems. For early-stage founders navigating technical decisions, guides on how to outsource software development for startups can help bridge the gap between concept and execution.

Java offers a whole ecosystem of libraries that can be used for financial data management and processing. It also has a huge potential in security features; its frameworks allow layering features on top of one another.

Go is popular for its simplicity and variability. It's mostly used in micro-serviced environments that process single operations in fast-paced environments.

The frontend of a fintech app plays a big role in earning users' trust. It needs to be easy to use, fast, and secure — while also showing complex financial data and updating often. React and Vue.js are two popular tools that help developers create smooth, good-looking user interfaces. To speed up frontend development without compromising quality, many fintech teams rely on IT outstaffing services to bring in skilled UI engineers on demand.

React is loved by programmers for its component-based infrastructure that allows fast integration in large-scale projects that fluctuate. Vue.js, on the other hand, offers a simple and gentle approach to website building with its performance.

Since most people use fintech apps on their phones, companies want their apps to work smoothly on both iOS and Android. Tools like React Native and Flutter make this easier by letting developers write one set of code for both platforms, saving time and money. Many businesses also tap into product development services to guide the entire mobile journey — concept, design, deployment, and iteration.

React Native works well with web apps built in React and is popular for its good performance and ease of use. Flutter, made by Google, is known for its great-looking designs and reliable performance on all devices. Both tools help fintech teams move fast, launch new features quickly, and keep things running smoothly.

When you're building a fintech product, picking the right development partner can make or break your fintech project. The right development team brings more than just coding skills — they understand financial regulations, security requirements, and how to build fintech software that won't fall apart when your user base grows.

Here are five companies that have proven themselves in the fintech software development space. Each brings something different to the table, whether you're a startup testing your first MVP or a financial institution modernizing legacy software.

Empat Tech works with companies that need custom fintech software development without the usual growing pains. Their team handles everything from mobile banking apps to payment systems, focusing on financial solutions that actually scale when you need them to.

What makes them different is how they approach fintech projects. Instead of throwing generic templates at you, they dig into your specific business challenges — whether that's connecting to legacy software or meeting compliance requirements in multiple markets. Their development teams have worked across different banking services, so they've seen what breaks and what holds up under real-world pressure.

They're particularly strong with companies moving from proof-of-concept to production. You'll work with fintech software developers who understand both the technical side and the business side of financial software.

SDK.finance takes a different approach — they've built a white-label banking platform that you can customize instead of starting from zero. This works well if you need to launch quickly but still want something that feels uniquely yours.

Their platform covers the core banking systems you'd expect: digital wallets, payment processing, lending management, and multi-currency support. Companies use it to build neobanks, payment apps, and fintech software solutions without spending months on basic infrastructure. The real advantage shows up when you need to add features or expand to new markets — the modular architecture means you're not rebuilding everything.

SDK.finance has been operating for over 15 years, mainly working with clients in Europe, the US, and the MENA region. They understand regulatory compliance across these markets, which saves you from learning the hard way about PSD2 or local banking requirements. Their team helps with both the technical implementation and the regulatory side, which is helpful when you're dealing with financial service providers that have strict compliance standards.

Orangesoft has spent 14+ years building financial software, primarily for startups and mid-sized companies trying to break into competitive markets. They've delivered over 300 projects, covering everything from portfolio management to crypto wallets.

Their strength lies in taking fintech ideas from concept to working product relatively quickly. When you're trying to validate whether users will actually use your personal finance management app or trading platform, you need a team that can build an MVP fast enough to test assumptions before your runway disappears. Orangesoft's process includes product discovery workshops that help you figure out which features matter and which ones you think matter.

They work primarily in fintech, healthcare, and IoT, which means they're not trying to be everything to everyone. Their developers understand the specific technical challenges that come with financial data — high transaction volumes, real-time processing, and security requirements that would make most web developers uncomfortable. They've built everything from payment software to wealth management platforms, always with regulatory compliance baked in from day one.

Brainhub specializes in .NET and JavaScript development for financial services companies. Since 2015, they've completed 80+ projects for clients ranging from seed-stage startups to Big Four consulting firms.

Their sweet spot is helping companies that already have a product but need to scale it properly. Maybe your current system works for 1,000 users but starts falling apart at 10,000. Or maybe you've accumulated so much technical debt that adding new features takes months instead of weeks. Brainhub's team comes in to fix the foundation while keeping your business running.

They've worked with companies like PwC and Credit Suisse, which tells you something about their ability to handle enterprise-level requirements. But they're equally comfortable working with fintech startups that need to move fast. Their approach combines strong UX design skills with backend architecture that won't crumble under pressure.

Innowise brings nearly two decades of experience building financial software for banks, fintech startups, and insurance companies. They're particularly strong in projects that need heavy compliance work or integration with existing core banking systems.

Their team size — over 3,000 developers — means they can handle large, complex projects that would overwhelm smaller agencies. When you're building something like a multi-country payment processing platform or modernizing a bank's entire digital infrastructure, you need serious engineering capacity. Innowise delivers that while maintaining the kind of security and compliance standards that financial institutions demand.

They cover the full range of financial software development services: core banking platforms, payment processing systems, lending software, investment tools, and RegTech solutions. Their experience with technologies like AI, blockchain, and cloud infrastructure means they can help you develop fintech software that won't feel outdated in two years. They're especially skilled at taking legacy systems and either modernizing them or building new platforms that integrate smoothly with what you already have. Their proven track record in the financial sector and industry knowledge give them a competitive edge.

Here's how these five fintech software development companies stack up against each other:

| Company | Experience | Team Size | Best For | Core Technologies | Geographic Strength | Standout Feature |

|---|---|---|---|---|---|---|

| Empat Tech | Proven track record | Mid-sized | Custom fintech solutions, companies scaling from MVP to production | Full-stack development, mobile banking, payment systems | Global reach | Deep understanding of both technical and business challenges in financial software |

| SDK.finance | 15+ years | Established team | Companies needing fast launch, white-label solutions | White-label platform, digital wallets, multi-currency payments | Europe, US, MENA region | Pre-built platform that cuts development time while maintaining customization |

| Orangesoft | 14+ years | 100+ developers | Startups and mid-sized companies, MVP development | React, Node.js, Python, AI, blockchain | Global, with focus on US and European markets | 300+ completed projects with strong product discovery process |

| Brainhub | Since 2015 | 80+ projects delivered | Scale-ups fixing technical debt, enterprise clients | .NET, JavaScript, React, Node.js, AWS | US and European markets | Strong UX design combined with enterprise-grade architecture |

| Innowise | Nearly 20 years | 3,000+ developers | Large-scale projects, legacy modernization, banks | AI/ML, blockchain, cloud, Python, Java | Global with strong European presence | Massive team capacity for complex, compliance-heavy projects |

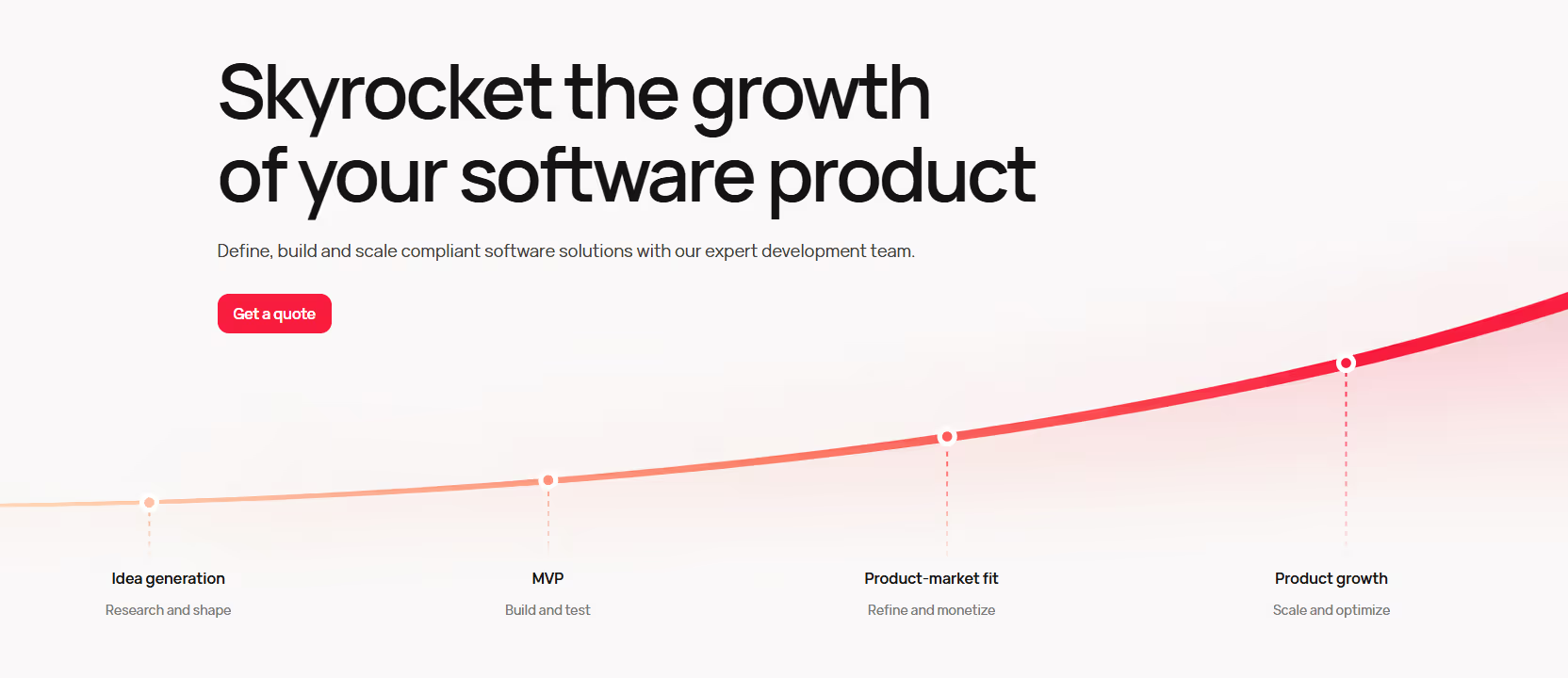

Fintech software is usually built in clear steps to reduce risks, work more efficiently, and keep the project on track. Let's go through each stage to see what's needed to build your fintech product.

The first stage of any development is the same. You need to find your user and prove that the concept of your product works. The discovery and validation stage offers just that. This step is especially critical in SaaS development, where long-term user retention hinges on solving a real, ongoing problem from day one.

During this part of the development process, you will research consumer behavior, understand the pains of your user, and optimize the concept of your product to fit those needs and wants. This is where you automate processes and define which financial processes need streamlining.

During this stage, designers create what's known as wireframes. It's a basic version of your product with just enough functions for your user to touch and use. If you're building from scratch, understanding how to hire developers for startup projects can help ensure your design vision translates into a functional, scalable product.

After you are set on the concept art of your product, you move on to the actual design that your users will see every time they open your app or website. This includes designing data analytics systems and financial analytics dashboards.

After the design is ready, developers move on to creating the actual functions of the product. It involves the front with all of the colorful buttons, menus, and other stuff and the backend. For companies looking to scale efficiently, software development outsourcing can be a smart way to speed up this phase without overloading internal teams.

Backend is the part that is responsible for the brains of the product. It will make sure that everything functions exactly as it was meant to, including corporate finance management and advanced analytics capabilities.

After everything is created, the product is transferred into the caring hands of QA&QC specialists who will troubleshoot all of the functions in a controlled environment to eliminate all of the bugs and unnecessary things. This is the polishing stage, where your fintech solution finally takes on full shape and form.

As soon as QA&QC gives their approval, the team moves on to the actual launch of the app. This stage actually started during discovery when the first concepts of your product were created. To meet tight launch timelines or scale up quickly, many teams bring in additional hands through staff augmentation services.

Specialists make everything to ensure that your product sees the light of day and is delivered to the market exactly the way you wanted it.

After the launch you can rely on your tech partner like Empat to make sure that your product stays updated and works as intended for as long as you need to. This is especially important in fast-moving areas like AI app development, where continuous updates are key to staying competitive and compliant.

Support services can be an endless process of perfecting your product, optimizing it, and making it overall better till the end of time.

Fintech software development is complex, no doubt about it. Handling sensitive financial data and navigating a maze of regulatory standards means there's a lot that goes into getting it right. But within that complexity lies a world of opportunity.

The chance to innovate how people pay, borrow, invest, and manage their financial lives has never been more real — or more exciting.

Whether you're building a secure wallet, a next-gen lending platform, or a powerful investment tool, success in fintech starts with understanding what you're getting into. That means knowing your product types, choosing the right technologies, and designing with regulatory compliance in mind from day one.

With the right foundation and a clear strategy, building a standout custom fintech software solution becomes achievable. Contact us, and let's create something great together!

What is fintech development?

Fintech development is the process of creating digital tools and platforms that improve or automate financial services, like payments, lending, investing, or personal finance management. It combines software development with financial expertise to build secure, scalable, and user-friendly products that meet the high standards of compliance and performance required in the financial industry.

Is fintech a high paying job?

Yes, fintech is generally considered a high-paying field due to the specialized skills it requires in both finance and technology. Professionals in roles like software engineering, data analysis, cybersecurity, and product management often earn above-average salaries, especially in major tech hubs or within successful fintech startups and enterprises. The demand for talent in this fast-growing industry helps drive competitive compensation.

What is the meaning of fintech services?

Fintech services refer to technology-driven solutions that improve, automate, or completely transform traditional financial processes. These services can include digital payments, online banking, investment platforms, lending tools, insurance tech, and more. The goal of fintech services is to make financial activities faster, more accessible, and more user-friendly for both consumers and businesses.